From TikTok to Twitter, all the recent stock market hype is driving more and more people to look for hacks and tips on how to time the market and buy and sell stock at the right time in order to make a profit.

While it’s a tempting and alluring strategy, timing the market—and actually getting it right—is really difficult and something even the professionals don’t get right most of the time.

In fact, a 2019 Vanguard study indicates that only 35% of active fund managers beat their market benchmark and they’re professionals. More so, studies repeatedly show successfully timing the market accounts for less than 2% of portfolio growth over time, while asset allocation accounts for over 90% of portfolio growth over time.

With the unique years we’ve had in 2020 and 2021, more people are investing and have time to monitor day trading and try their best to time the market to strike it rich. Unfortunately, no crystal ball shows when one stock price will swing and when to act.

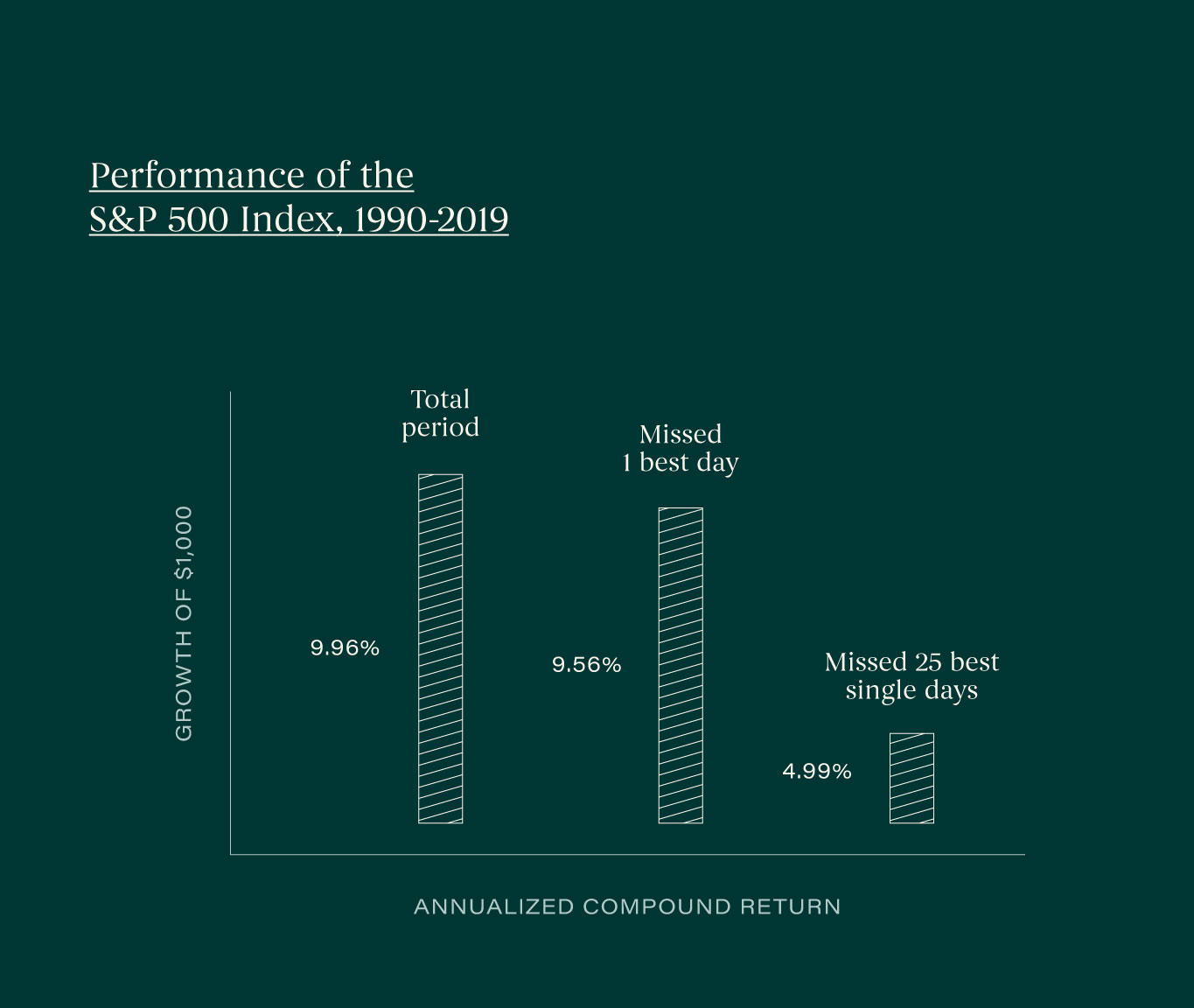

Let’s dive into an example. The S&P index from 1990-2019 has had an average annual rate of return of 9.96%. So let’s say you invested $1,000 into the S&P index in 1990 and let it ride the entire time. At the end of 2019, your portfolio would have been $17,273. But now, let’s look at a different scenario. Let’s say you tried to time the market and get in and out at the right time to capture more return, but instead, you missed it and therefore missed the single best trading day in that almost 30 year period of time. If that was the case, then your average annual rate of return drops to 9.56%. If you missed the 25 best trading days in that same timeframe, then your average annual rate of return drops to 4.99%, making your total portfolio ending value at just $4,314. Now, which scenario would you prefer—a portfolio value of $17,273 or $4,314?

*Indexes cannot be invested into directly, past performance does not guarantee results.

So the moral of the story is that market timing is very difficult, especially with technology and the fast pace trading world we live in. Not only is it hard to do, but it’s stressful since you must constantly be considering whether to get in and out of a particular investment at the right time while being glued to your screen daily to try to find all the right information. So while it may seem like you have an edge and know when to get in and out, you would probably be better off going to Vegas and gambling your money.

Instead, focus on finding a long-term strategy that makes sense for you and takes your goals, timeframe, risk tolerance, tax strategies, and everything else into consideration. Then create a buy-and-hold portfolio for 90% of your investable assets. If you want to take the other 10% and do more trading in the market, then you can have your cake and eat it too.

About Learn

Financial advice for real people, by real people. You shouldn't need a degree to understand your money. Join Head of Education Brittney Castro and Altruist mentors as they break down financial tips and strategies in a real way to help you finally understand how to achieve your financial goals faster.