Do you know how much money you’ll need to save up to retire? Interestingly enough, more than half of American adults don’t have a clue how much their nest egg target should be.

For many people, retirement planning can seem complicated and intimidating. If you do it wrong and save too little, then you might risk running out of money and looking for work in your elderly years. Or worse, it could mean losing your home or jeopardizing your health.

Luckily, retirement planning isn’t as complex as what most people would like you to believe. In fact, if you follow a few simple guidelines and avoid cutting corners, then it can actually be a relatively straight-forward process.

In this post, we’ll tackle that important question of “how much do I need to retire?” and provide you with the insight to create a plan that works for you.

How much income will you need?

First and foremost, knowing how much money to save for retirement will primarily depend on one thing: You!

Retirement planning should start by defining what you want your life to be like after you’ve separated from work. Of course, if you’re married, then this vision should be expanded to allow for the lifestyle that both you and your spouse want to aspire to live. In order to quantify this vision, you’ll need to ask yourself the following questions:

What will your retirement expenses be?

Just like your day-to-day life now, certain expenses will be somewhat unavoidable. These might be things like:

- Your mortgage

- A car payment

- Food

- Utilities

- Insurance

- Etc.

To understand what your anticipated living expenses will be during retirement, it will be important to spend some time looking through each line of your current budget and determining if it will be an expense that carries over into retirement or not.

If you’d like to simplify this process (or just have no idea what this number might be), then a solid rule of thumb is to estimate 70% to 80% of your current pre-tax household income. For example, if you’re making $50,000 now, then a reasonable assumption would be that you’d continue to need $35,000 (70%) to $40,000 (80%) per year as a retiree.

How will you plan to spend your time?

Imagine for a minute that today was your last day at work and you were suddenly retired. With all of your new free time, what will you do:

- Tomorrow?

- A month from now?

- A year from now?

- Ten years from now?

Without a job to keep you occupied, you’re going to need daily activities to keep yourself busy and your mind sharp. You can do this by giving some thought as to what projects, hobbies, or ambitions you might wish to pursue and how these might impact your overall budgetary needs.

For example, now that you’re retired, you might wish to finally go travel the world and see new destinations each year. While ambitions like this are certainly encouraged, they also have to be done responsibly. Estimate how much extra money you’d need to achieve this dream and then factor it into your anticipated annual expenses.

What will your goals be?

Retirement doesn’t have to be all about relaxing on the beach or hitting the golf courses. For many people, it can also be a time of introspection and a chance to leave your mark on this planet.

For instance, you might decide it's time to finally start that family business or non-profit that you’ve always wanted to have. Even though a well-run business will eventually be profitable and self-sustainable, in its infancy, you’re going to need some start-up capital to get it off the ground and moving.

No matter what you’d like to build or how you’d like to influence the lives of others, the only way it will ever have a chance to come true is if you include it in your plan. The sooner you know this ahead of time, the easier it will be to fund your dreams and watch them turn into reality.

How much money should I save in my nest egg?

Once you have some idea of what your lifestyle will cost in retirement, you can then determine what your nest egg savings target will be. Here’s how to do this.

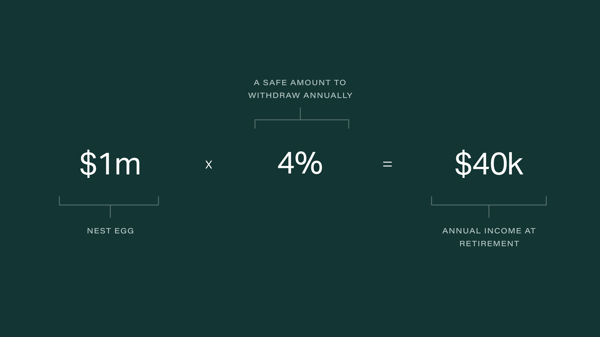

One of the simplest ways to estimate how much money should be in your nest egg is to use something called the 4 Percent Rule. This is a widely popular financial study that looked at historical market data from the past 50 years and concluded what a “safe withdrawal rate” from your savings would be.

To summarize, the 4% Percent Rule says you should be able to withdraw up to 4% from your retirement savings every year for the next 30 years without fear of running out of money. For instance, if you had $1 million in your nest egg, then you should be able to pull out the following amounts every year to cover your living expenses:

- $40,000 the first year

- $41,200 the second year (adjusting 3% for inflation)

- $42,436 the third year (adjusting 3% for inflation again)

- And so on …

Keeping this in mind, if you know in advance how much you’d like your retirement expenses to be, then you can work the same calculation in reverse and determine what your savings target should be. For example, if your goal was to produce $40,000 of retirement income, then you can divide this number by 4% (0.04) and calculate a goal of:

- $40,000 / 0.04 = $1,000,000

How long do you plan to be retired?

Another factor that will play a big role in your nest egg savings target is determining how many years you’ll spend in retirement. To better understand this, you’ll need to answer two important questions:

- At what age do you plan to retire? Will you retire at age 60 like most people, or are you saving aggressively so that you can separate from your employer in your 50s or even 40s?

- How long do you think you’ll live? Though it's never fun to think about your own mortality, this will be a very vital factor in determining how long your money will last. Obviously the longer you’ll live, the longer you’ll need your money to last. Generally speaking, unless you’ve got some pre-existing health conditions, assume that you’ll live to be 100 years old so that don’t cut yourself short financially.

You probably noticed that the 4 Percent Rule is only applicable for periods of 30 years. If you were planning on being retired for longer than this (like 40 or 50 years), then you may need to recalculate your savings goal using a more conservative withdrawal rate of 3.5% or even 3%. In those cases, your new nest egg savings targets would increase as follows:

- $40,000 / 0.035 = $1,142,857

- $40,000 / 0.03 = $1,333,333

How will your savings be invested?

One more important detail of the 4 Percent Rule is that it assumes your nest egg will be invested in 60% stocks and 40% bonds.

Although to some retirees the heavier allocation in stocks may seem risky, you have to remember that stocks have classically produced much higher long-term returns than bonds. When compounded, this higher average growth rate is what will help to sustain your retirement savings over the 30-year period, regardless of fluctuations in the market.

If you’re somewhat risk-averse when it comes to investing and would prefer to allocate a higher percentage into bonds, then it's likely your portfolio will produce lower returns. Therefore, you might again have to consider reducing your withdrawal rate and increasing your savings target just to be on the safe side.

How will other factors impact your retirement savings target?

If saving up $1 million or more sounds like a bit of a stretch goal, then don’t worry. There are some additional influences for you to be mindful of that can significantly impact your savings goal:

Social Security

An interesting and sometimes misunderstood detail about the 4 Percent Rule is that it does not take into consideration payments from Social Security. This is actually an additional income stream that would supplement your nest egg withdrawals, and potentially reduce how much you’d need to save overall.

With the average Social Security benefit being approximately $1,500 per month ($30,000 per year), you can subtract this number from your retirement expenses if you plan to retire starting around age 62 (when most people become eligible to start receiving benefits). For example,

- If we assume you’ll need $40,000 when you’re retired but you’ll receive $30,000 in Social Security benefits, then your nest egg really only needs to produce $10,000 of income per year.

- In that case, using the 4 Percent Rule, your new nest egg savings target could be reduced to $250,000.

Pensions

Though pension plans seem to be a thing of the past, if you happen to work for an employer that still offers one, then this should also be taken into your equation. Similar to Social Security, you can reduce your anticipated living expenses by the amount of your anticipated pension payments and lower your overall savings target.

Part-time Employment

Though working during retirement may sound somewhat contradictory, it’s become more commonplace than you’d think. As many as 40 percent of retirees end up returning to the workforce, not necessarily because they need the money, but because it gives them a sense of purpose and lets them be social with others.

If you wouldn’t mind working during retirement, even if it's just part-time, then this can be yet another way to reduce your nest egg savings target. In fact, using the 4 Percent Rule, we can estimate that for every $1,000 per month you plan to earn consistently throughout retirement, this can reduce your savings target by as much as $300,000.

Consider reducing your retirement expenses.

Finally, if you’ve taken everything into account and your retirement savings target still seems too far out of reach, then your last line of defense will be to consider lowering your anticipated living expenses. Similar to part-time employment, for every $500 per month that you can cut out of your retirement budget, that’s $150,000 less you’ll need to save in your nest egg.

We’ll leave this as an option of last resort because your retirement shouldn’t have to be a time of restriction. It should be your opportunity to live out your golden years enjoying financial freedom and security to do exactly the things you’ve always wanted to do. This is why it will be important to work on planning your retirement as far in advance and with as accurate of assumptions as possible.

The bottom line:

Thanks to the 4 Percent Rule, you can easily calculate how much money you’ll need to retire. If you think you’ll be investing conservatively or retired for longer than 30 years, then you may need to plan more conservatively. However, if you’ve got other sources of income available, then this could help reduce your overall savings target.

Above all, the main thing you’ll need to do is anticipate how much money you’ll need to live happily every year in retirement. Start with this, and it will be an investment that leads to a retirement that is safe, secure, and full of possibilities.

Disclaimer: In no way should use of the word 'pro' be interpreted as providing potential investors any accreditation or level of sophistication.