One of the scariest things about retirement planning is the fear that you’ll outlive your money.

Let’s face it–no one wants to be forced to return to work in their elderly years or, even worse, risk losing their homes or being unable to pay for proper healthcare.

Because of this issue, it's been reported that as many as 60% of Americans are investing too conservatively when it comes to their retirement (according to The Motley Fool). Unfortunately for these people, they’re prioritizing loss avoidance at a time when they should be letting their nest eggs grow for long-term sustainability.

While dips in the market can leave you feeling uneasy, the good news is that there are plenty of ways to curb investment risk while still making a decent return. In this post, we’ll explore some of these strategies for investing safely and how this should be weighed against your retirement goals.

What makes an investment safe?

There are several types of investments which are traditionally considered to be “safe”:

-

- High-interest savings accounts

- Money market accounts

- CD’s

While these types of assets may have been more attractive in the past when interest rates were higher, many unfortunately pay little to no return now that Federal interest rates are near zero. For instance, you’d be lucky to find an online savings account or CD that pays more than 1% interest.

That’s a problem when you consider inflation. Inflation is the natural tendency for the price of all goods and services to rise over time.

Over the past 100 years, the average annual rate of inflation has been approximately 3% per year. That means that if your investment isn’t producing at least a 3% return every year, then you’re technically losing purchasing power with each passing year due to inflation.

This is why ultra-conservative investments like these can do almost more harm than good. Although they are indeed safe, what you need are assets that will return a more attractive rate of return.

Risk vs reward

To produce a higher rate of return, many people will then jump to the other end of the investment spectrum and start looking into assets like stocks and real estate. However, as you might expect, with more potential reward usually comes more risk. Sometimes this may be more than what you might be willing to accept.

For instance, index funds that track the S&P 500 (the top 500 large-cap stocks on the market) are often recommended by many financial experts as great investments to have in your nest egg. This is because they typically produce average returns of 10% over the long-term. That’s not too bad!

However, stocks also inherently carry a lot of risk and can decrease in value without warning; sometimes for several years in a row. For example, the Great Recession of 2008 is often remembered by many as when the stock market lost more than 50% of its value over just a few months. Many people who had retired shortly before this had to strongly reconsider their plans after their nest eggs were cut in half in just under one year!

Therefore, what you need is a way to invest your money that’s somewhere in the middle – something that strikes a reasonable balance between risk and reward. But does such a thing even exist?

Modern portfolio theory

In the 1950s, an economist named Harry Markowitz proposed and was later given the Nobel Prize for what’s become known as modern portfolio theory.

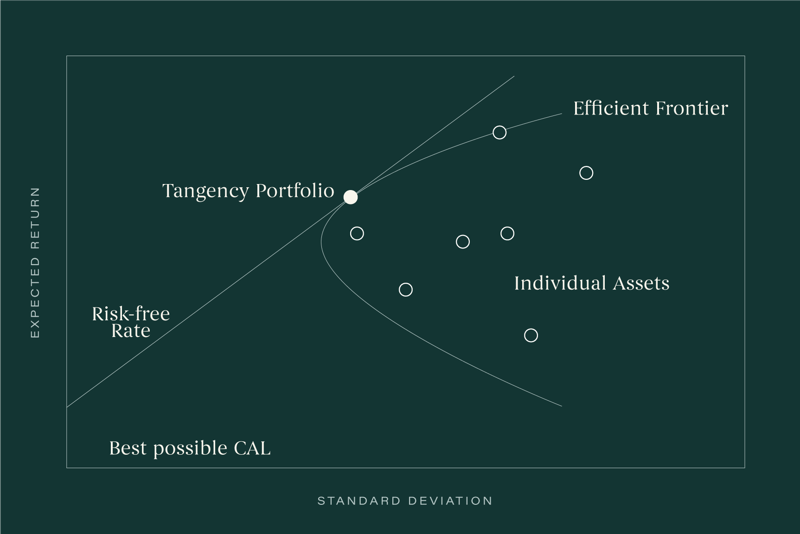

Essentially, this is an attempt to help investors construct a portfolio that maximizes returns based on the level of risk they are willing to accept. Portfolios are characterized by what’s known as the efficient frontier. This is a curve that slopes upward plotting the relationship between an increased rate of return versus the perceived risk for various combinations of investments.

Why is this important? Because we learn from modern portfolio theory that diversification is the key to reducing volatility while increasing the expected rate of return. For instance, someone who invests 100% in bonds would actually be taking on more risk with a lower return potential than someone who invests partially in both stocks and bonds.

For the optimal balance between risk and reward, what you need is a healthy mixture of stocks, bonds, as well as other assets. For example, if you’ve ever heard someone say that a 60% stocks / 40% bonds portfolio is the best way to diversify, then they are quoting modern portfolio theory.

Focus on the long rate of return

When it comes to retirement planning, you can really see how portfolio diversification plays a big part in making your dollars last.

Consider how the 4 Percent Rule says that you’d be safe to withdraw at least 4% from your nest egg over the next 30 years. If we look at the success rates behind this study that were presented in the Trinity Study, we can see that the more diversified our portfolio is, the better our chances will be:

-

- 100% stocks / 0% bonds = 95% success rate

- 75% stocks / 25% bonds = 98% success rate

- 50% stocks / 50% bonds = 95% success rate

- 25% stocks / 75% bonds = 71% success rate

- 0% stocks / 100% bonds = 20% success rate

In summary, the more heavily invested you are in lower risk investments like bonds, the more it reduces the amount of earnings your portfolio will produce over time. This increases the unwanted possibility that you’ll run out of money sooner rather than later.

Again, you’ll need to be open to taking on some investment risk if you want to produce a reasonable rate of return. Fortunately, not all investments are the same, and here are some that you’ll want to consider.

Relatively safe investments for your retirement nest egg

Dividend stocks

Dividend-paying stocks are highly sought-after by investors because, as the name implies, they have a history of paying "dividends". A dividend is a share of the earnings that the company gives to their stockholders, usually once per quarter.

Dividend-paying stocks give investors the benefit of receiving regular payments while also having the potential for the share price to increase in value. This means that even during turbulent years when the stock may decrease in value, you will still most likely continue to receive your dividend payments which results in a nice hedge against your losses.

Investors also like the fact that companies that pay dividends are usually better off financially. Fundamentally, in order to pay a dividend, the company has to be making earnings. This is not always the case with other types of more aggressive stocks where the companies may actually be losing money.

You can buy dividend stocks individually, or you can purchase mutual funds and ETFs whose core focus is dividend stocks.

Value stocks

Another way to invest in stocks without taking on too much risk is to focus on a sector of what’s known as “value stocks”.

Value stocks are usually larger, more well-established companies that are currently trading for less than what they are really worth. Since the stock market is fickle, share prices can fall for a variety of reasons. However, that’s good news for investors because it means there’s an opportunity to scoop up the stock at a good price before it goes up in value.

Value stocks are traditionally more stable than growth stocks. Growth stocks are ones that investors believe have great future potential. Stocks of this nature can produce higher rates of return but are also prone to significantly more risk, especially when the company doesn’t live up to investor expectations.

Similar to dividend-paying stocks, you can invest in value stocks by buying them individually, or through mutual funds and ETFs that specialize in this market sector.

Balanced funds

Remember how we said that modern portfolio theory suggests we need a good mix of stocks and bonds? Well, with a balanced fund, you can buy exactly just that – all in just one purchase.

Nearly every investment company offers one or more types of balanced funds. These securities will usually be designed to appeal to a broad range of investor risk tolerances.

Taking this concept one step further, some companies also offer a special version of balanced funds called “target-date funds”. These are balanced funds where the ratio of stocks and bonds automatically adjusts as time goes forward. The idea is that as you get older and closer to retirement, your asset allocation should slide from aggressive to more conservative.

Corporate bonds

Usually, when financial advisors talk about investing in bonds, they’re referring to government bonds since they have been a well-known safe-haven for investors. However, with interest rates cut to nearly zero, you may want to expand your horizon and look to other types such as corporate bonds.

Like government bonds, corporate bonds are instruments of debt. The issuing company must pay back the bondholder their principal plus interest.

Because companies are more at risk to go bankrupt than the government, their bonds are also considered riskier. Hence, this is why they also pay higher interest rates. Yet, keep in mind that because they are bonds, they still have far less volatility than even the safest stock-based funds.

The easiest way to purchase corporate bonds is through mutual funds and ETFs.

Real Estate Investment Trusts

If you’d like to diversify beyond just stocks and bonds, then another type of security you may want to consider is a REIT (real estate investment trust).

A REIT is a fund that owns and operates a variety of real-estate and infrastructure-based assets. This allows you to own property without physically purchasing or managing it.

If that’s not enough, REITs also pay out handsome dividends to their shareholders, averaging approximately 5% per year. Similar to dividend stocks, these payments can make a nice hedge against market losses while adding some well-rounded portfolio diversification.

However, REITs are not without risk. In fact, in some instances, REIT share prices can fluctuate even more than stocks. The most effective strategy when it comes to investing in a REIT is to simply hold the asset long-term and collect the dividend payments while holding off on making any withdrawals until it's absolutely necessary.

Dozens of mutual funds and ETFs specialize in REITs. Some focus on commercial real estate like office buildings and warehouses while others invest in infrastructure and cell towers.

How to build a guaranteed income stream

Another alternative for producing retirement income that has been used as far back as the time of the ancient Romans is annuities.

What is an annuity?

An annuity is a contract between you and an insurance company where they agree to pay you a specified amount of money every month for the rest of your life.

For many risk-averse investors, annuities can be an attractive way to produce retirement income since you won’t outlive your money and you’ll still be paid no matter what happens in the stock market.

How do annuities work?

Annuities are purchased by handing over a large sum of money to the insurer. The amount of benefit that they will pay you in return will depend largely on your age, gender, and several other important factors.

To give you some idea of the monthly payout, NerdWallet found that an annuity purchased for $100,000 would produce the following payouts for these individuals:

-

- A single man (age 65) = $529 a month or $6,348 per year.

- A single woman (age 65) = $501 per month or $6,012 per year. The lower payout is because women statistically live longer than men.

- A couple (age 65) = $438 per month or $5,256 per year. The reduced amount is because the annuity will continue to pay up until the second person passes away.

The most common type of annuities are “immediate fixed annuities.” These contracts will pay out a fixed, guaranteed amount of money every month. Payments are usually adjusted for inflation.

There are also other types of annuities. For example, variable annuities change their monthly payments based on how the markets are performing. There are also fixed index annuities where only a certain portion of the payment will be guaranteed and the rest is free to fluctuate with the markets. Both of these types of annuities have the potential to pay a higher monthly benefit but can carry more risk.

So what's the catch?

Although annuities may sound like a great deal, like any investment, you’ll have to also consider the potential downsides:

-

- Loss of principal: unlike a retirement nest egg where you retain both your principal and the earnings, you will not get back your initial contribution with an annuity. This means you will not be able to leave this money to your heirs (unless you also buy this option with your annuity which will most likely dramatically reduce the size of your benefits).

- Complexity/hidden fees: one of the biggest complaints you’ll find with annuities is that their terms are complex. Often, they also have several fees that can eat away at your returns; some of which you may not even be fully aware of until after the contract has been purchased.

- Stability of the insurer: there is always the possibility that if the insurance company providing the annuity goes bankrupt, then they may stop sending you your annuity payments. This is why it will be very important to carefully research and choose a reputable insurer.

For more information about annuities, please check out this resource from the U.S. Securities and Exchange Commission.

The bottom line

When it comes to retirement planning, investment products like savings accounts and CDs just won’t produce the returns you’ll need to make your money last throughout the rest of your life. To truly optimize your nest egg’s potential, you’re going to need to work with investments that will achieve a reasonable rate of growth. Weigh this against your risk tolerance, and you’ll be able to sleep at night knowing that your money is doing exactly what it should be.

Disclaimer: In no way should use of the word 'pro' be interpreted as providing potential investors any accreditation or level of sophistication.